Understanding the financial dynamics of a business requires a deep dive into its key performance indicators, with cash flow and net income being at the forefront. These two financial metrics, while interconnected, provide distinct insights into a company’s financial health and operational efficiency. In this extensive exploration, we will dissect the components, significance, and nuances of cash flow and net income, and elucidate the stark differences between them, with a particular focus on the role of accruals.

Cash Flow: The Pulse of a Business

Cash flow stands as a paramount indicator of a company’s financial stability, representing the net amount of cash and cash equivalents being transferred into and out of a business. It is the lifeblood of any organization, ensuring that operations run smoothly, debts are paid, and investments are made for future growth.

Breaking Down Cash Flow

Cash flow is categorized into three primary types, each painting a different picture of a company’s financial activities:

- Operating Cash Flow: Derived from the core business operations, it reflects the cash generated from sales and the cash used to pay for goods and services. It is a direct indicator of a company’s operational efficiency and its ability to generate sufficient cash to sustain its activities.

- Investing Cash Flow: Encompasses cash used for purchasing capital assets, making investments, and other long-term commitments. A negative investing cash flow is common in growth phases, indicating reinvestment for future benefits.

- Financing Cash Flow: Involves cash transactions related to the company’s equity and debt, including dividends, loans, and stock issuance. It shows how a company raises capital and repays its investors.

Net Income: Deciphering the Company’s Earnings

Net income, often referred to as the bottom line, is the total profit of a company after all expenses, taxes, and additional costs have been subtracted from total revenues. It serves as a universal measure of profitability and is a critical component in financial reporting and analysis.

Components and Calculation

Net income is calculated using the following formula:

Net Income=Total Revenue-Total Expenses

Key components include:

- Revenue:The total income generated from sales and services.

- Cost of Goods Sold (COGS): Direct costs associated with the production of goods or services.

- Operating Expenses:Indirect costs such as salaries, utilities, and rent.

- Taxes and Interest: Payments made to government entities and on borrowed funds.

- Depreciation and Amortization: The systematic allocation of the cost of assets over their useful lives.

Distinguishing Cash Flow from Net Income: The Role of Accruals

Distinguishing Cash Flow from Net Income: The Role of Accruals

- Cash Flow is concerned with the actual movement of cash, providing a real-time snapshot of a company’s liquidity. It is straightforward, transparent, and rooted in tangible cash transactions.

- Net Income , on the other hand, is calculated using accrual accounting, which recognizes revenue and expenses when they are incurred, not necessarily when cash changes hands. This includes non-cash items such as depreciation and accounts receivable, providing a comprehensive view of profitability over a specific period.

The Role of Accruals

Accrual accounting plays a pivotal role in the calculation of net income, allowing for the recognition of transactions that do not involve an immediate exchange of cash. This method ensures that financial statements reflect the economic reality of transactions in the periods they occur, rather than when cash is received or paid. However, this also introduces a level of complexity and subjectivity, as it requires estimates and judgments, potentially leading to manipulation and inaccuracies.

The Susceptibility of Net Income to Manipulation

Net income’s reliance on accrual accounting makes it inherently more susceptible to manipulation compared to cash flow. The inclusion of non-cash items and estimates provides management with a degree of discretion in how income and expenses are recognized, leading to opportunities for earnings management. Companies might manipulate net income to meet earnings targets, influence stock prices, or achieve favorable loan terms. This manipulation can take various forms, including altering depreciation schedules, recognizing revenue prematurely, or deferring the recognition of expenses.

Cash flow, with its basis in actual cash transactions, is less prone to such manipulations. The transparency and tangibility of cash flow make it a more reliable metric for assessing a company’s financial integrity, providing stakeholders with a clearer picture of the company’s ability to generate cash and sustain its operations.

Cash Conversion Cycle: A Vital Metric for Operational Efficiency

The Cash Conversion Cycle (CCC) is a critical metric that measures the time (in days) it takes for a company to convert its investments in inventory and other resources into cash flows from sales. It encompasses three main components:

- Days Inventory Outstanding (DIO): Reflects how long it takes for a company to sell its entire inventory. A lower DIO indicates quick inventory turnover.

- Days Sales Outstanding (DSO): Measures the average number of days it takes for a company to collect payment after a sale has been made. A lower DSO is preferable as it indicates faster collection of receivables.

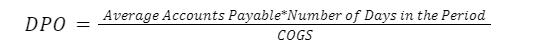

- Days Payables Outstanding (DPO): Represents the average number of days it takes for a company to pay its bills and invoices. A higher DPO is beneficial as it means the company can hold onto its cash for a longer period.

The formula to calculate CCC is:

CCC=DIO+DSO-DPO

A lower CCC indicates that a company is efficiently managing its inventory and receivables, and is able to quickly convert its resources into cash, which is crucial for maintaining liquidity and ensuring the smooth operation of the business. On the other hand, a higher CCC might indicate inefficiencies in inventory management or issues with collecting payments, which could lead to cash flow problems. Understanding CCC in conjunction with cash flow and net income provides a comprehensive view of a company’s operational efficiency and financial health.

Let’s Calculate CCC for Grupa Kety S.A. for the year 2021

Given Data:

- Inventory (as of 31.12.2021): 263 200 zł

- Trade and other receivables (as of 31.12.2021): 304 955 zł

- Accounts Payable (as of 31.12.2021): 171,000 (in PLN ‘000)

- Revenue from contracts with customers (for 2021): 1 645 923 zł

- Cost of Goods Sold (COGS) (for 2021): 1 164 338 zł

- Number of Days in the Period: 365 days

Calculations::

The Cash Conversion Cycle for Grupa Kęty S.A. for the year 2021 is approximately 97 days. This means that, on average, it takes the company around 97 days to convert its investments in inventory and other resources into cash flows from sales. This metric provides insight into the efficiency of the company's operations and its cash flow management.

Data was downloaded from:

https://grupakety.com/wp-content/uploads/2022/05/2021RocznesprawozdaniefinansoweGrupyKetySAANG.pdf

Conclusion

In sum, cash flow and net income are indispensable metrics in financial analysis, each serving unique purposes and providing valuable insights. Cash flow offers a transparent and straightforward view of a company’s liquidity, while net income provides a comprehensive measure of profitability, incorporating both cash and non-cash items. Understanding the role of accruals in net income is crucial for distinguishing between these two metrics, ensuring a holistic and accurate assessment of a company’s financial standing. The susceptibility of net income to manipulation further underscores the importance of scrutinizing both metrics to gain a complete understanding of a company’s financial health.