In this article, we will delve into an analysis focused on the sectors that are overrepresented in key European stock indices. By understanding which industries dominate indices such as the CAC 40, DAX, or WIG20, we can reveal which types of companies have the greatest impact on the dynamics of these markets, leading to rises or falls. This analysis will not only highlight the current structure and driving forces of the markets but also help us predict what factors may contribute to the future growth or decline of these indices.

Assigning Sector Weights in Indices

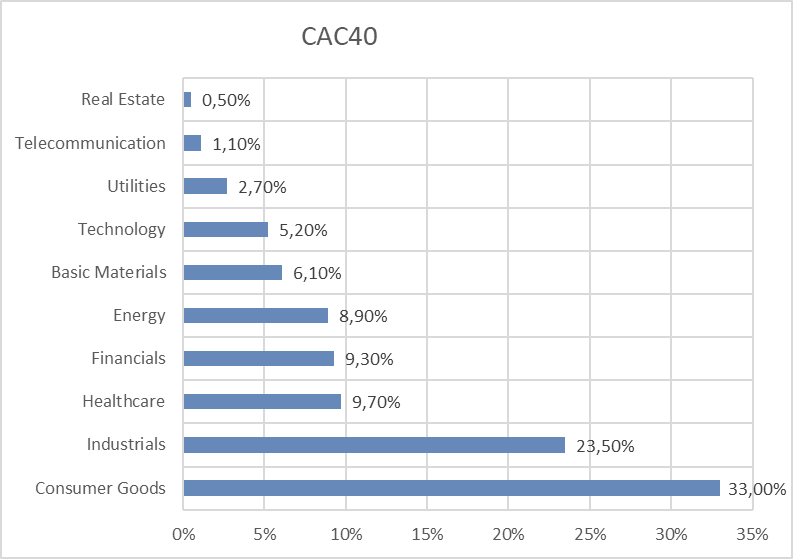

Let's start by explaining the concept of weighting, which is fundamental to understanding the causes of imbalances that appear in stock indices. Take, for example, the CAC40, in which industrial companies constitute as much as 23.5% of its value. It is the weighting mechanism that determines the impact individual companies have on the overall index. When large sectors, such as the industrial sector, are dominated by high market capitalization firms, they naturally carry more weight in the index. This process leads to imbalances that reflect not only the state of the market but also reveal which sectors of the economy have the greatest influence on the dynamics of the index.

How Sector Weight Influences Changes in Stock Index Value

Understanding the weightings of individual sectors in an index, such as the CAC40, can be crucial for predicting how various economic events will affect its value. For instance, if the industrial sector, which accounts for as much as 28% of the index, experiences a slowdown due to a shortage of supplies from China, we can expect this to have a significant impact on the entire index. A decline in a sector carrying such weight can substantially reduce the value of the CAC40. Conversely, changes affecting smaller sectors, such as telecommunications, which may result from new EU legislation and represent only 2% of the index, will have a much smaller impact. Knowledge of the weightings of the various sectors enables investors and analysts to make more accurate predictions and strategies, allowing for a better understanding of potential economic and political effects on the market.

The Issue with Legacy Companies

Many stock indices include companies known as "legacy companies," such as Deutsche Post, Axa, or PZU. These are well-established companies with a long history, often playing a significant role in their national economies. Although these entities are powerful, they are frequently considered to have limited growth prospects compared to more modern and efficiently operating enterprises. The presence of these stable but stagnant firms within indices can suppress their dynamics, as the lower volatility of these stocks translates into smaller movements up and down the indices. When considering investing in various indices, it is worth taking into account whether they contain too many such companies.

Benchmark

European stock indices exhibit significant differences in the distribution of sector weights, reflecting the diversity of the continent's economies and the unique specializations of individual countries. The American S&P 500 often remains the gold standard for global comparisons due to its diversification and representativeness of the world's largest economy, serving as a benchmark. Yet, even it has recently been incredibly dominated by technology, and its recent gains are mainly due to tech companies. In Europe, each index has its nuances: for example, in Denmark, healthcare sector companies make up 40% of the index, with Novo Nordisk alone accounting for one-third of this value. In Poland, the WIG20 is characterized by a massive share of the financial sector, which constitutes 41% of the index, indicating a market dominated by banking corporations and financial services. These unique index weight distributions influence which events cause strong downward and upward movements.

Conlusion

Investing in broad stock indices requires a thorough understanding of their sector composition, which is crucial for diversification strategies and risk management. For example, if an investor has a pessimistic outlook on the future of the healthcare sector, then investing in the Swiss SMI index, where this sector accounts for as much as 38%, might not be the best decision. Additionally, it's important to analyze whether an index is burdened with "legacy companies," which, although stable, may limit the growth potential of the index and be less responsive to innovations and market changes. Proper understanding and assessment of an index's sector composition allow investors to make more informed choices and assist in analyzing the future of these indices.

| Wig 20 | CAC 40 | DAX | AMX | ATX | OMXC25 | IBEX 35 | FTSE 100 | SMI | |

| Healthcare | + | + | + | ||||||

| Financials | + | + | + | + | + | + | |||

| Industrials | + | + | + | + | |||||

| Consumer goods | + | + | + | + | |||||

| Energy | + |

CAC40

The chart displays the distribution of various sectors within the CAC 40 index, with luxury goods (28.4%) and industry (23.5%) occupying dominant positions. Sectors like real estate and telecommunications hold a minor share. This indicates that fluctuations in stock prices within the luxury and industrial sectors could significantly influence the movements of the entire index, whereas changes in real estate and telecommunications are likely to have a limited impact.

Wig20

Finance is the most dominant sector, suggesting its strong influence on the direction of the index. The sectors of trade and services, as well as energy, also play significant roles. Technology and consumer goods, although present, have a relatively smaller impact on the index. This arrangement indicates that changes in the financial sector could be crucial for overall index movements, while fluctuations in smaller sectors might not be as distinctly felt in the market.

IBEX 35

The Financial Sector has the largest share, indicating its key role in this index. Energy and fuels also hold important positions, while technology, consumer goods, basic materials, and resources have a moderate impact. Real estate and services sectors represent only a small percentage of the index. This structure suggests that changes in the financial and energy sectors could have significant implications for the overall value of the IBEX 35.

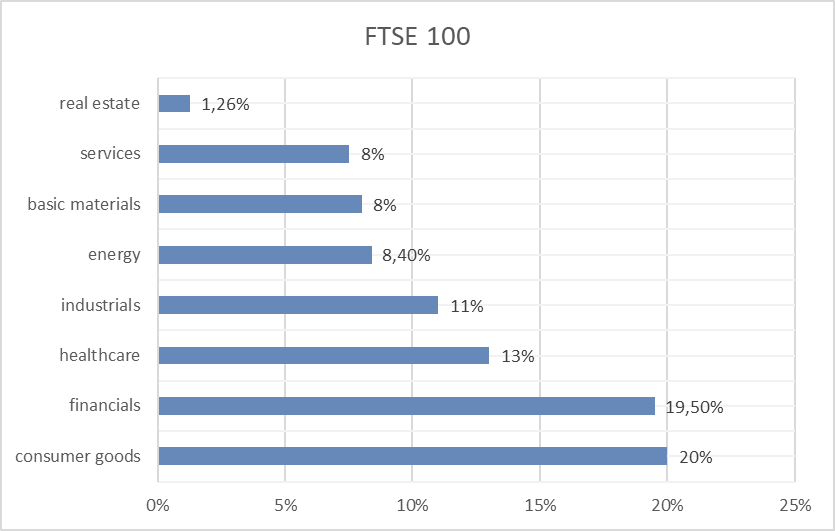

FTSE 100

Consumer goods hold the largest share, indicating their significant impact on the index. The financial sector also has a considerable share, while the health and industrial sectors have a moderate share. Energy, basic materials and resources, as well as services, have similar, moderate sizes of shares, whereas real estate constitutes the smallest part of the index. The dominance of consumer goods and finance suggests that changes in these sectors are likely to have a significant impact on the movements of the FTSE 100 index.

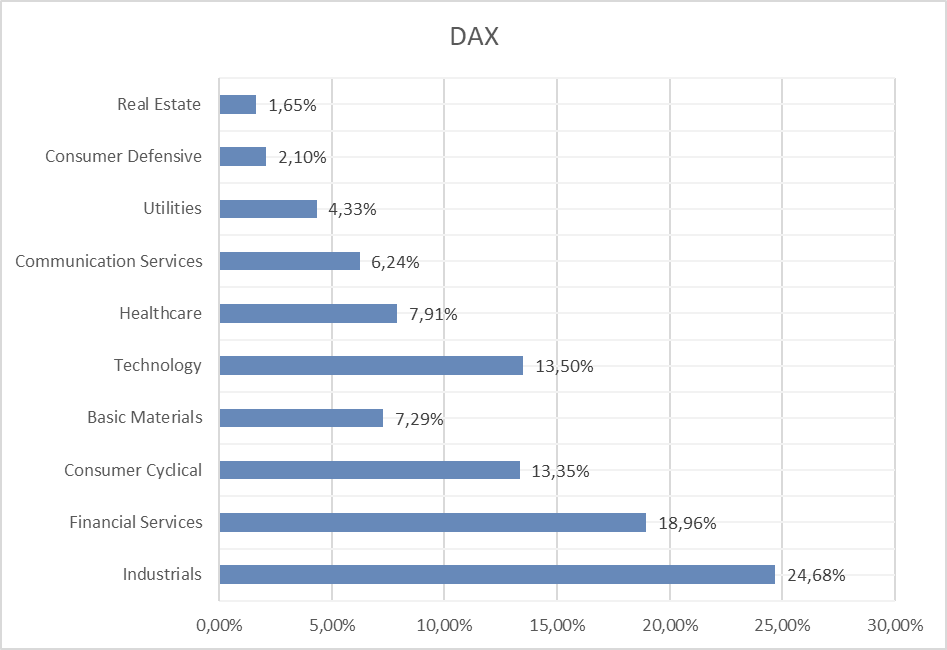

DAX

The industrial sector has the largest share, reflecting Germany's strong position as an industrial powerhouse. This is followed by the financial services and cyclical consumer goods sectors, suggesting a balanced presence of financial services and a mature consumer goods market. Technology and healthcare also constitute significant components of the index, indicating the innovation and advancement of these sectors in the economy. Sectors such as communication, utilities, defense, and real estate have smaller shares, demonstrating their lesser impact on the overall dynamics of the index.

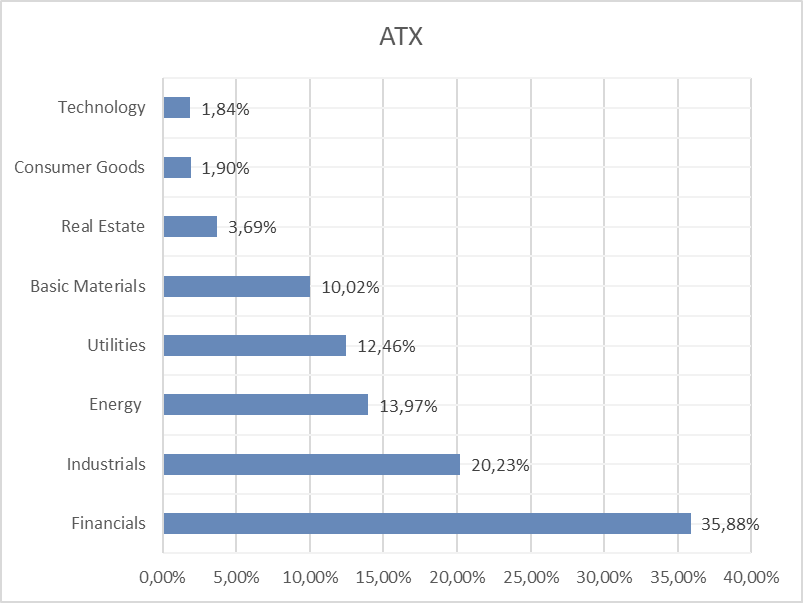

ATX

The financial sector holds the largest share, accounting for over one-third of the index, emphasizing the central role of banking and financial services in Austria's economy. The industrial sector also has a significant share, indicating a solid manufacturing base in the country. Energy and utilities occupy important positions as well, reflecting the importance of these services for infrastructure and the economy. Compared to these sectors, technology and consumer goods have a relatively small share in the ATX index.

SMI

The SMI is characterized by a dominant healthcare sector, which constitutes 38% of the index. The consumer goods sector also has a significant share, demonstrating Switzerland's strength in producing high-quality consumer goods. The financial and industrial sectors hold 19% and 15% shares respectively, reflecting the important role of these industries in the country's economy. There is also a noticeable small share of sectors such as communication, basic materials, and technology. The absence of investments in real estate and public utilities in this index may indicate the specific nature of the Swiss market and a focus on sectors with high export significance and innovation.

OMXC25

The healthcare sector dominates the index, accounting for nearly 42% of its value, which may reflect a focus on advanced medical and pharmaceutical technologies in Denmark. The industrial sector also has a significant share, while the financial and energy sectors have similar, moderate sizes of shares. Consumer goods occupy a smaller part of the index. This sector arrangement indicates a specialization of the Danish stock market and can influence investment decisions, especially in the context of sectors with high growth potential like healthcare.

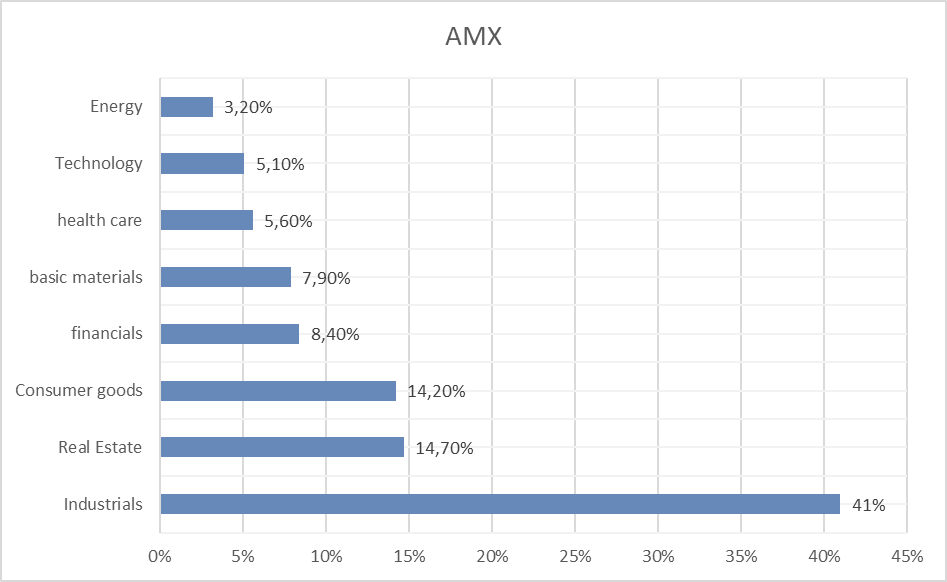

AMX

The healthcare sector is predominant in the index, representing almost 42% of its value, likely indicating Denmark's emphasis on advanced medical and pharmaceutical technologies. The industrial sector also plays a major role, whereas the financial and energy sectors contribute with similar, moderate proportions. Consumer goods form a lesser portion of the index. This distribution of sectors suggests a specialization within the Danish stock market, potentially impacting investment choices, particularly in areas with substantial growth prospects, such as healthcare.